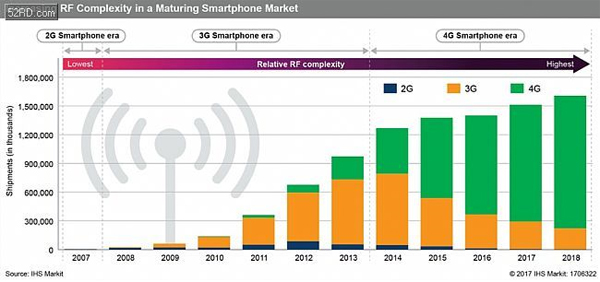

Smartphones are one of the most widely used and versatile electronic devices in the world today. They have gained tremendous popularity in the past decade and have become the main communication medium in the digital world. In some cases, especially in developing countries, smartphones may be the only computing device a user has. Just 10 years ago, there were less than 4 million smartphones listed. In contrast, IHS Markit estimates that global smartphone shipments will exceed 1.5 billion a year from 2017. Today, users are more concerned about the functions of the market, such as screen, camera, memory, processor and software. However, the function of RFFE RF front-end (devices between RF transceivers and antennas) is often overlooked, and its function is actually the key to the mobility of smartphones. Radio frequency performance can be a promoter of excellent mobile broadband experience, or a hindrance.

Since the widespread adoption of LTE technology, radio frequency front-end (RFFE) has been supporting an increasing number of bands and air interface formats, while overcoming the size and cost constraints imposed by other parts of smartphone design.

The transition from 2G to 3G technology has led to a geometric progression in RFFE complexity; the transition from 3G to 4G has also led to an exponential increase in RFFE complexity, which adds 4x4 MIMO antenna architecture and carrier aggregation in addition to increasing frequency bands. At the same time, in an increasingly competitive environment, OEM vendors may focus on the aforementioned photography features, and when these features are more visible than ever before, OEM vendors may be less interested in RF front-end.

According to the IHS Markit Wireless Semiconductor Competition Report, the size of the mobile phone RF front-end device market has increased from $4.3 billion in 2010 to about $13.4 billion in 2017, with a compound annual growth rate of more than 17.7%. During this period, the growth rate of the RF device market was five times that of the semiconductor market as a whole. This amazing achievement highlights the importance and complexity of the RF front end.

To uncover one of the most critical aspects of smartphone design, the RF front-end, IHS Markit will launch a series of in-depth RFFE analyses. These articles will discuss the trends in device integration, increasing complexity, and some of the key technical attributes required for superior RF performance as the market moves towards the adoption of 4G + and 5G technologies. This article is the first in this series.

The progress of LTE has promoted the development of RF devices market.

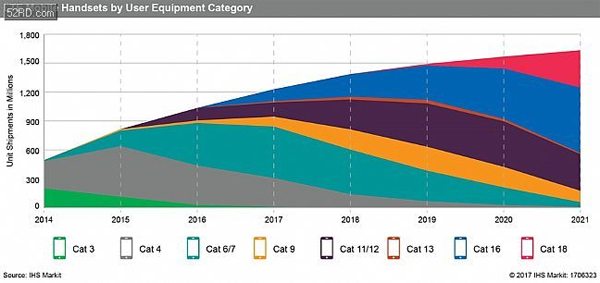

As the number of bands supporting LTE increases, technologies such as carrier aggregation have emerged to drive higher data transmission rates. Carrier aggregation is a combination of individual RF bands that can create wider bandwidth and faster download and upload speeds for a given device. This technology emerged with the emergence of advanced version LTE, basically LTE Cat 4 and above. Starting with Cat 4 LTE, the device can achieve a 150Mbps or higher data rate. The latest available modem is Cat-16 LTE, which can increase the data rate to about 1Gbps. Next year, Cat18 devices can even reach the speed of 1.2Gbps data transmission. To achieve these extraordinary speeds, mobile devices must support more sending and receiving channels, and additional receiving channels become more complex and require support for more and more carrier aggregation combinations because of the 4x4 MIMO design. As higher-order LTE evolves to higher-order LTE Pro, the number of carrier aggregation combinations increases exponentially, with only 200 CA combinations in 2015. Two years later, the number of combinations at this stage will exceed 1,000.

Device integration to prevent SKU surging

Ten years ago, smartphones could be considered a "global phone" with only about five bands to support, and LTE now has about 50 bands, not even a possible carrier aggregation combination. Just a few years ago, OEM manufacturers could launch a single SKU smartphone globally, although that was a challenge at the time. Most smartphones released today have at least two to four versions to solve the problem of supporting all major networks around the world. Apple is the only high-end smartphone OEM manufacturer to achieve a single SKU globally via the iPhone 4S, but this may be the last chance for high-volume devices to achieve this goal, especially as LTE technology advances. Apple's iPhone 4S only needs to deal with 3G technology with relatively few bands, and once Apple enters the LTE era, a single SKU is no longer an option. The new iPhone 5, released at the end of September 2012, has three different models, each supporting a different set of LTE bands. Smartphones leave limited room for RF devices, which must be integrated into modules to support more and more bands. In addition, devices such as power amplifiers (PAs) must support not only a set of frequencies, but also multiple modes. These multi-mode, multi-band PAs are surrounded by other devices, such as front-end modules that integrate RF switches, duplexers, and filters.

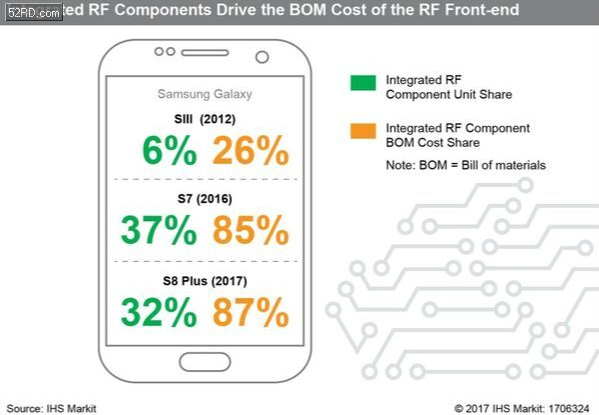

Compared with today's flagship smartphones, a look at the status of the early LTE smartphone RF front-end highlights the importance of device integration. For example, only 6% of the major RF devices found in Samsung Galaxy SIII in 2012 were integrated into modules, which accounted for 26% of the RFFE BOM (excluding RF Transceivers). In contrast, modularized devices account for 87% of RFFE BOM in Samsung Galaxy S8 Plus.

Not all OEM vendors will adopt the same approach to RF device integration, depending on the target market for smartphones; they may choose to use a hybrid approach of discrete and integrated RF front ends. RF providers such as Skyworks, Qorvo and Qualcomm provide various levels of integrated RF devices. For OEM vendors that focus on entry-level, local or customized handsets, they may choose to use more discrete RFs in their designs. However, even with regional mobile phones, the degree of modularity is getting higher and higher. For regional SKUs, OEM vendors will use an integrated approach to signal amplification and switching, using only discrete filters and duplexers. The front-end module (FEM), which combines a switch and a filter, can be used in a diversity receiving channel to facilitate carrier aggregation. In addition to diversity reception front-end modules, OEM vendors are turning to integrated front-end modules for the main transmission and reception components for most flagship smartphone designs worldwide, some of which can cover low, medium, and high frequency bands supported by smartphones. Generally speaking, there is a direct relationship between the integration level of RF front-end and the BOM cost of RF part in smart phones with similar design and pricing.

Modular propulsion, filter flag flags

Although devices in smartphones are becoming more modular, the number of filters used in each cell is expected to increase over time. For every radio frequency band supported by mobile phone, there are two or more filters. As a result, the number of filters (integrated or otherwise) per handset will continue to increase over time, with some models supporting more than 30 LTE bands per handset possibly having more than 70 filters. This is a trend of sustainability, especially in the high-end smartphone market. To accommodate the number of filters that the phone needs in the future, RF filters will need to be further integrated into the module and integrated with other functions, such as antenna switches and power amplifiers.

System level expertise: Winning in RF needs more than device integration.

With so many bands and formats currently supported by high-end smartphones, the need for system-level expertise from RF vendors has never been greater. The most successful RF suppliers will be those with system-level collaborative design capabilities for different product combinations, including digital baseband and antennas. These suppliers will be able to meet the most extensive needs of customers. These include the need to produce powerful and low-power devices, while providing smartphones with the fastest continuous download and upload speeds. In addition, OEM vendors must meet the needs of mobile network operators so that their devices can communicate with the network as efficiently as possible. Few vendors can combine the entire RF front-end functionality with their products, which is one of the main reasons why only a few vendors dominate the mobile phone RF device market.

In the smartphone market, the current integrated RF front-end design will be the basis for the smartphone transition to support 5G technology in the next few years. With the implementation of new radio designs and more and more software controls, RFFE will have to support a wider range of frequencies. The range of RF frequencies will be expanded from 700 MHz to 5 GHz to 600 MHz to 60 GHz, although higher frequencies are not mobile. In addition, higher-level modulation and more air interface technologies will emerge, which will increase RF complexity. The performance challenges posed by 5G cannot be solved by device integration alone, but at the system level and within RFFE. Looking to the future, RFFE must be optimized for system-level tunability, and technologies such as envelope tracking and antenna tuning will be necessary to meet users'higher expectations of performance, energy efficiency and battery life. In the next article in this series, IHS Markit will delve into envelope tracking technology, explain its importance, and its current and future popularity with LTE devices worldwide.